Live Stock Market Alert Types

Live Stock Market Alerts for Traders – Live stock market alerts are an essential tool for traders, providing real-time updates on the performance of stocks, indices, and other financial instruments. These alerts can help traders stay informed about market movements and make timely trading decisions.

There are several different types of live stock market alerts available to traders, each with its own advantages and disadvantages.

Price Alerts

Price alerts are one of the most common types of live stock market alerts. These alerts are triggered when the price of a stock or other financial instrument reaches a specified level.

- Advantages:Price alerts are simple to set up and can be used to track multiple stocks or other financial instruments.

- Disadvantages:Price alerts can be triggered by short-term price fluctuations, which can lead to false signals.

Volume Alerts

Volume alerts are triggered when the volume of trading in a stock or other financial instrument reaches a specified level.

- Advantages:Volume alerts can be used to identify stocks or other financial instruments that are experiencing a surge in trading activity, which can be a sign of a potential trend.

- Disadvantages:Volume alerts can be triggered by large block trades, which can lead to false signals.

News Alerts

News alerts are triggered when a news event occurs that could affect the price of a stock or other financial instrument.

- Advantages:News alerts can provide traders with real-time information about events that could impact their investments.

- Disadvantages:News alerts can be overwhelming, and it can be difficult to filter out the noise.

Technical Analysis Alerts

Technical analysis alerts are triggered when a technical indicator reaches a specified level.

- Advantages:Technical analysis alerts can be used to identify trading opportunities based on historical price data.

- Disadvantages:Technical analysis alerts can be complex to set up and interpret, and they can be unreliable.

Sources of Live Stock Market Alerts

Live stock market alerts can be obtained from various sources, each with its own level of reliability, accuracy, and cost.

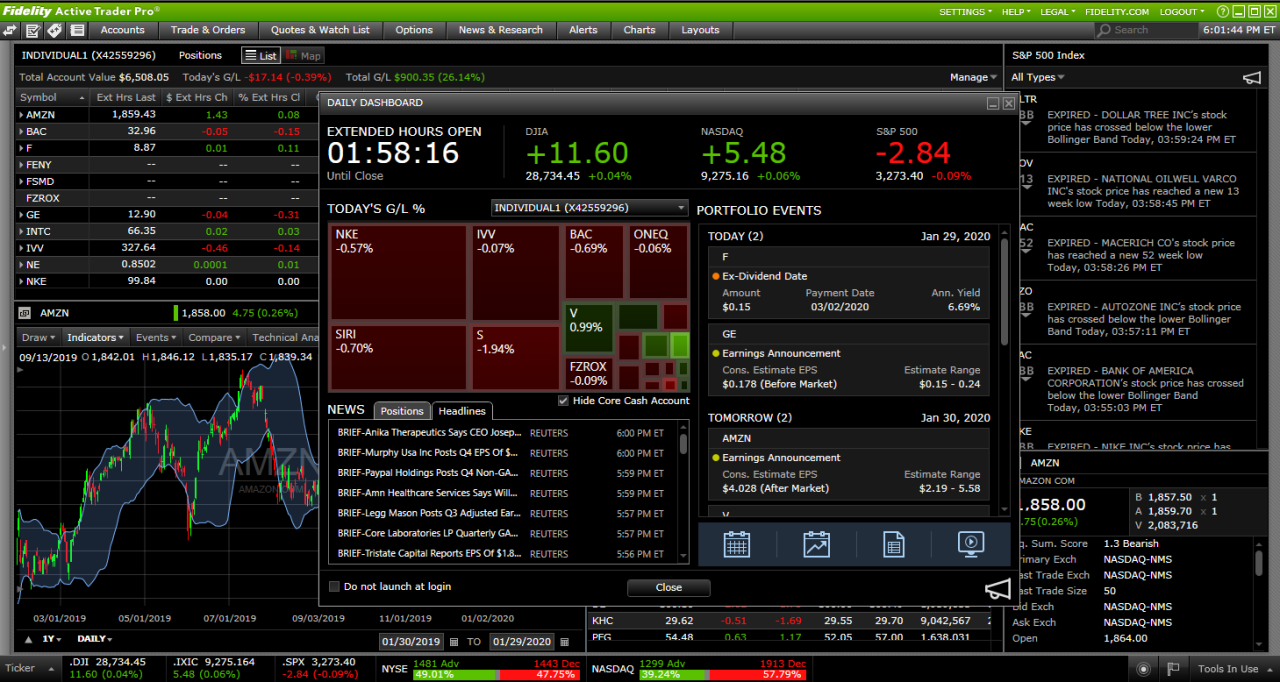

Online Brokers

- Most online brokers offer live stock market alerts as part of their trading platforms.

- These alerts are typically based on pre-defined criteria, such as price changes, volume thresholds, or moving averages.

- The reliability and accuracy of these alerts can vary depending on the broker’s data sources and algorithms.

- The cost of these alerts is usually included in the broker’s trading fees.

Financial News Websites

- Many financial news websites provide live stock market alerts for free.

- These alerts are often based on news events or market analysis.

- The reliability and accuracy of these alerts can vary depending on the source of the information.

- Some websites may offer premium services that provide more in-depth alerts or real-time data.

Social Media

- Social media platforms, such as Twitter and Reddit, can be used to receive live stock market alerts.

- There are many traders and analysts who share their insights and trade ideas on social media.

- The reliability and accuracy of these alerts can vary widely, as there is no guarantee of the expertise or intentions of the individuals providing the information.

- Using social media for stock market alerts can be free, but it may require some effort to find and follow reputable sources.

Mobile Apps

- There are many mobile apps available that provide live stock market alerts.

- These apps typically offer a range of features, such as customizable alerts, real-time data, and news updates.

- The reliability and accuracy of these apps can vary depending on the developer and the data sources they use.

- Some apps are free, while others may require a subscription fee.

Using Live Stock Market Alerts: Live Stock Market Alerts For Traders

Live stock market alerts can be invaluable tools for traders looking to make informed decisions and stay ahead of the market. By effectively using these alerts, traders can gain real-time insights into market movements, identify trading opportunities, and manage their risk.

To effectively use live stock market alerts, it’s important to understand how to set them up, customize them to your specific trading needs, and interpret and respond to them appropriately.

Setting Up and Customizing Alerts

Setting up and customizing live stock market alerts is a straightforward process. Most trading platforms offer a range of alert options, allowing traders to tailor alerts to their specific trading strategies and preferences.

- Choose the right alert type:Determine the type of alert that best aligns with your trading strategy, whether it’s price alerts, volume alerts, or technical indicators.

- Set the alert parameters:Specify the conditions that will trigger the alert, such as a specific price level, volume threshold, or technical indicator signal.

- Customize alert delivery:Choose how you want to receive alerts, such as via email, text message, or push notification.

Interpreting and Responding to Alerts, Live Stock Market Alerts for Traders

Once alerts are set up, it’s crucial to interpret and respond to them effectively. Not all alerts are created equal, and it’s important to distinguish between genuine trading opportunities and false signals.

- Consider the context:Evaluate the alert in the context of the overall market conditions and your trading strategy.

- Confirm the signal:Use additional technical analysis or fundamental analysis to confirm the validity of the alert.

- Take appropriate action:Based on your interpretation of the alert, decide whether to enter or exit a trade, adjust your position, or take no action.

Benefits of Live Stock Market Alerts

Live stock market alerts provide traders with numerous benefits that can enhance their trading performance. These alerts can help traders stay informed about market movements, identify trading opportunities, and make informed decisions in a timely manner.

Improved Market Awareness

Live stock market alerts provide traders with real-time updates on market events, such as price fluctuations, news announcements, and economic data releases. By receiving these alerts, traders can stay abreast of market developments and make informed decisions based on the latest information.

Early Identification of Trading Opportunities

Stock market alerts can help traders identify potential trading opportunities by notifying them of specific price movements or market conditions. For example, a trader may receive an alert when a stock’s price crosses a certain threshold or when a technical indicator signals a potential trend reversal.

Enhanced Risk Management

Live stock market alerts can also assist traders in managing risk by providing them with early warnings of potential market downturns or adverse events. For example, an alert may be triggered when a stock’s price falls below a critical support level, indicating a potential reversal in the trend.

Increased Trading Efficiency

Live stock market alerts can streamline the trading process by eliminating the need for constant manual monitoring of the markets. By receiving alerts only when specific conditions are met, traders can focus on other tasks while still staying informed about market movements.

Case Study: Successful Traders Using Alerts

Numerous successful traders have attributed their success to the use of live stock market alerts. For instance, George Soros, a renowned hedge fund manager, is known for his extensive use of market alerts to identify trading opportunities. By receiving alerts when specific market conditions were met, Soros was able to make timely and profitable trades.

Limitations of Live Stock Market Alerts

While live stock market alerts can be valuable tools for traders, they also have certain limitations and drawbacks. Traders should be aware of these limitations to make informed decisions about using alerts.

Potential for False Signals

One of the main limitations of live stock market alerts is the potential for false signals. False signals occur when an alert is triggered but the underlying market movement does not meet the trader’s expectations. This can lead to missed opportunities or even losses if the trader takes action based on the false signal.

Missed Opportunities

Another limitation of live stock market alerts is the potential for missed opportunities. Alerts are only triggered when certain conditions are met, and there is always the possibility that the alert will not be triggered when a profitable trading opportunity arises.

This can lead to traders missing out on potential profits.

Mitigating the Risks

Traders can mitigate the risks associated with using live stock market alerts by taking the following steps:

- Use multiple alerts.Using multiple alerts from different sources can help to reduce the risk of false signals and missed opportunities.

- Confirm the signal.Before taking action based on an alert, traders should always confirm the signal by looking at the underlying market data.

- Use alerts as a supplement.Live stock market alerts should be used as a supplement to other trading tools and strategies, not as a replacement for them.